This report is available for full download to PDF.

Tunisia Landscape

Emerging social enterprises work towards the development of effective solutions to challenging social and environmental problems. These enterprises often take different organizational forms and require collaboration across government, business, and nonprofit sectors [1]. This report utilized desk research and key informant interviews with startup founders, incubators, and investors in Tunisia to determine the status of the social innovation sector, and potential gaps and opportunities for development.

In Tunisia, the social innovation sector is rapidly expanding with $22.1 million spent by investors and 47 deals made in 2018. Of these investments, 79% are local and 21% are international [2]. The sector is supported by new government initiatives stemming from the Digital Tunisia 2020 strategic plan, aiming to increase high-tech industries and promote socioeconomic development. This includes the Smart Tunisia plan to create 50,000 jobs in digital products and services and develop a regional hub for technology outsourcing.

Augmenting this work, the Tunisian Parliament passed the Startup Act in 2018 [3]. The Startup Act’s purpose is to facilitate the launch and development of startups, defining startups as firms with the following characteristics:

- Less than eight years old;

- Less than 100 employees and less than 15 million dinars annual turnover (~5,237,925 USDConverted July 2019);

- More than 2/3 company capital owned by natural persons, regulated investment organizations, or foreign startups;

- Technologically innovative business model;

- Scalable potential

Once a firm receives the Startup Label, it is eligible for a number of incentives including the ability to take one-year of leave from regular employment, tax exemptions, and skill training for employees [4]. The target is the creation of 500 startups by 2023 [2].

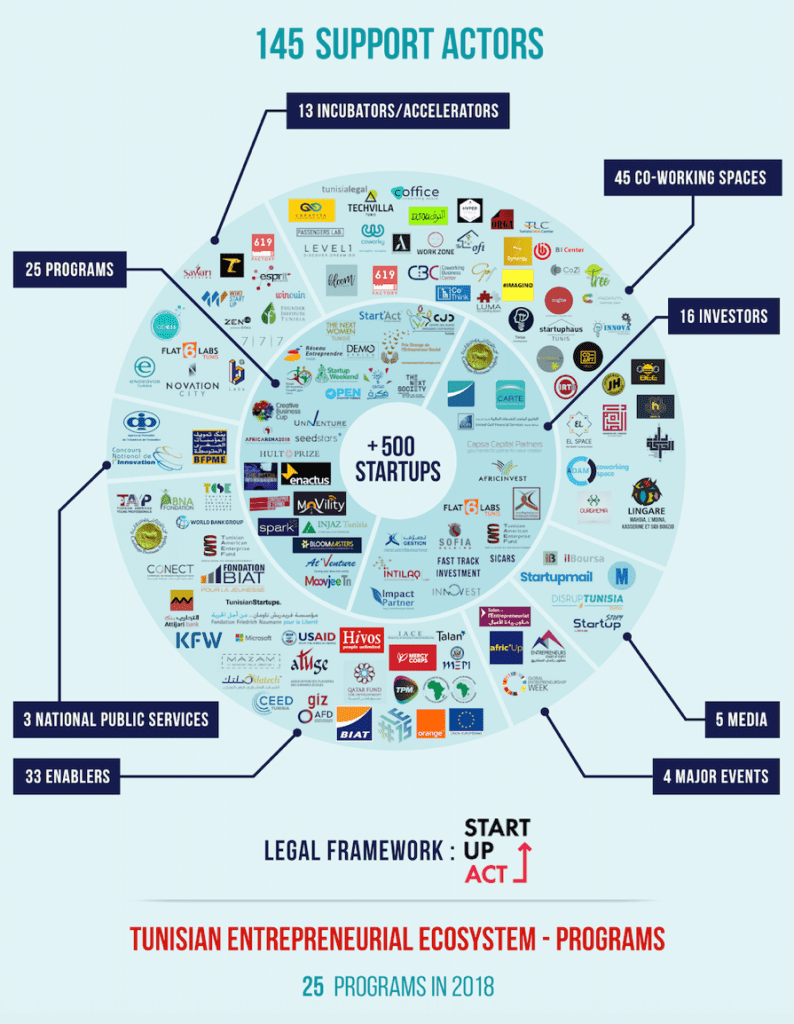

Working in tandem with these initiatives are 145 entrepreneurial support actors, including 13 incubators and accelerators, 16 major investors, and 45 coworking spaces [5]. Figure 1 displays different innovation sectors and total funding received in 2018.

Emerging Trends

2018 saw maturation in the startup sector, with investments increasing 215% and an additional 21 investment deals over 2017. An increasing number of local incubators and accelerators are emerging to provide the sector with technical and financial support [6].

Interviewees described a diversity of social enterprises, strong talent, and robust unique selling proposition (USP) in emerging startups. There is a trend towards data science projects, increasing development of Artificial Intelligence, new Virtual Reality and Augmented Reality programming, and the creation of a few fabrication laboratories (fablabs) and makerspaces. While these areas are emerging, Tunisia lags behind global averages in research and development expenditure (as a percentage of GDP) and high-technology exports (Figure 2), but there is an increasing number of researchers working in R&D and growing amounts of intellectual property (Figure 3).

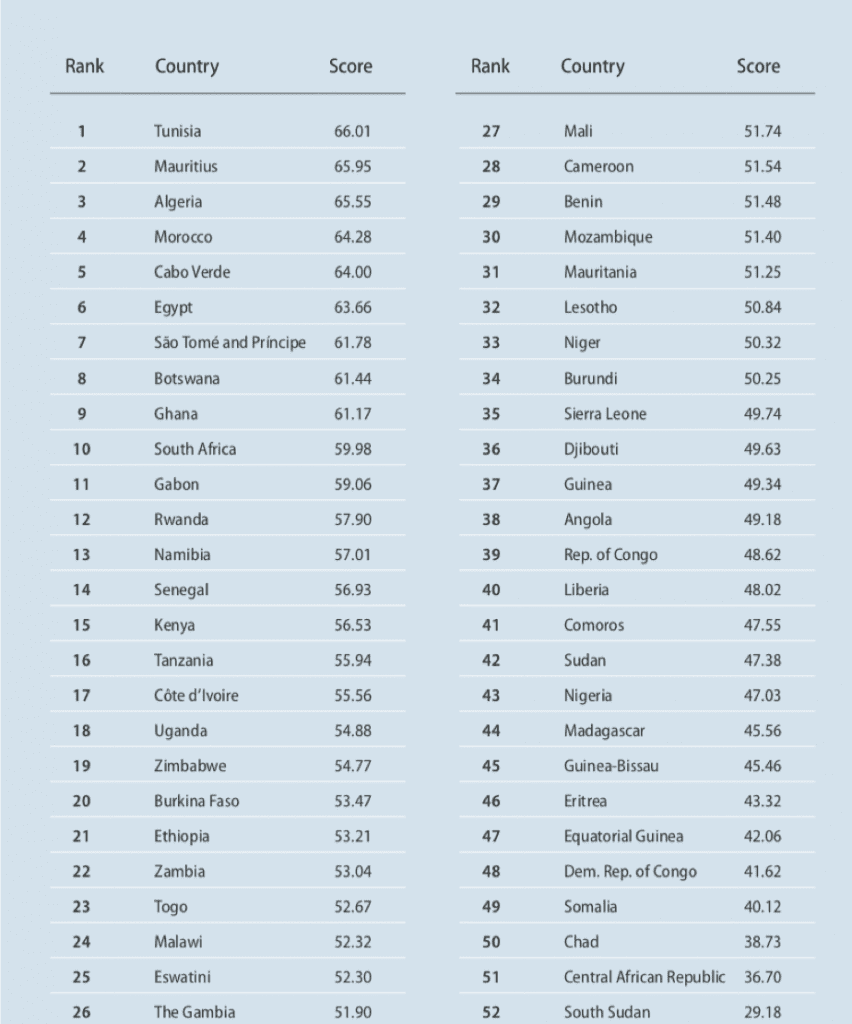

The 2019 Africa Sustainable Development Goal (SDG) Index and Dashboards report identified Tunisia as the top-ranked country on the continent towards achieving the SDGs. Analyzing performance on 97 indicators across all 17 goals, Tunisia scored the highest in Africa at 66.01, indicating the country is 66% of the way towards achieving the SDGs (Appendix 2).

Social Innovation Gaps

During interviews with entrepreneurs and support actors, they highlighted the challenge of marketing innovations in Tunisia and competing internationally. Additional backing is needed – from both the public and private sectors – in the forms of financial and legal support for small and medium enterprises (SMEs). While there are increasing amounts of money and investment partners in Tunisia, 65% of the investments are initial support, and only 35% of the money is provided for follow-up investments [2]. There is also a lack of mentorship from existing social enterprises for new social innovators.

Interviewees also discussed the siloed nature of funds (certain funds only allocated for fintech, or for agriculture, etc.) and the risk aversion of international investors as barriers to innovation. While there is a lot of emphasis placed on startups, there is not a social enterprise framework for firms with a specific social impact focus, or a delineation or incentive for this type of enterprise. Innovators further discussed technical challenges, including lack of technical skill emphasis in the educational system and the need for increased digitization of services and open government data. Open government data allows people to make informed decisions, and innovators leverage this access to create applications and services. Data.gov, for example, has resulted in applications about air quality, bank ratings, product recalls, and food security, to name a few [8].

Specific SDG performance trends are displayed in Figure 4. For Goal 9 – Industry, Innovation and Infrastructure – Tunisia was classified as having significant challenges ahead in meeting the research and development expenditure and logistics performance (quality of trade and transport-related infrastructure) indicators [3].

Opportunities

Though there remain gaps in the social innovation sector, there are a number of opportunities for growth. Clarifying strategic sectors and a long-term investment horizon would provide social enterprises with a structure for expansion. Strengthening partnerships among the nonprofit, private and public sectors would allow for enhanced collaboration and a more resilient social innovation sector.

Additionally, increasing technological interaction in educational curriculum would bolster the future of the entrepreneurial sector. Experience with AI and VR, and particularly exposure to computer science, data science and software engineering in primary and secondary education, was cited by interviewees as a necessary component to ensure the skill development of future entrepreneurs. Additionally, a key recommendation was mentorship between experienced and startup social enterprises would share best practices and could be amplified by supplementary programming with a focus on marketing skills.

Ultimately, a number of different complementary assets must exist for social innovation. A study evaluating the impact of subsidies in Tunisia’s Industrial Upgrading and Modernization program on information and communication technology (ICT) adoption found that, while all firms would have adopted less ICT had they not received the financial aid, the effect on ICT adoption differed depending on the type of technology and the region. Financial support to any social enterprise must be coupled with research and development, human capital, and organizational improvements.

For new social innovations, there are sector-specific needs in Tunisia [9]. Interviewees were asked to select three United Nations SDGs whose achievement hinged on technological advancement in Tunisia. The results in Figure 5 indicate a stark demand for innovation in the Education, in addition to advances in the Industry, Innovation and Infrastructure category, Sustainable Cities and Communities, and for Peace, Justice, and Strong Institutions.

The legend of Figure 5 indicates scoring and the current dashboard evaluation of achievement progress for SDGs. It appears that respondents’ technological assessments differ from general SDG performance, as the goals of Gender Equality, Affordable and Clean Energy, and Decent Work and Economic Growth are the SDGs most off-target for achievement. There is an opportunity for social innovation work and technology for development advances to target these areas for new programs and innovations.

Ultimately, the social innovation sector in Tunisia is emerging and thriving, but there remain challenges and opportunities to ensure innovators have growing and resilient social enterprises.

Appendix 1: Tunisia Startup Ecosystem Public and Private Sectors [5]

Appendix 2: SDG Index Rankings [3]

References

- Stanford Graduate School of Business, 2019, “Defining Social Innovation”

- Entrepreneurs of Tunisia, 2018, “Startups Fundraising 2018 Tunisia”

- SDG Center for Africa and Sustainable Development Solutions Network, 2019, “2019 Africa: SDG Index and Dashboards Report”

- Startup Act, 2019, “What is the Startup Act?”

- Entrepreneurs of Tunisia, 2018, “Tunisia Startup Ecosystem”

- Entrepreneurs of Tunisia, 2018, “Graduation 2018”

- World Bank, 2019, “DataBank World Development Indicators”

- Data.Gov, 2019, “Applications”

- Khalifa, A.B., 2018, Government Supports and Technology Adoption: Evidence from Tunisia. Journal of Economic Development, 43(4), pp. 41-69.

Editors: Jen Ventrella, Grace Burleson

Additional contribution: Mehemed Bougsea, Mariela Machado

No Comments.