Product Description

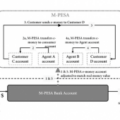

M-Pesa is a transformative mobile banking service launched by Vodafone for Safaricom in 2007. It lets people make small amount transactions using SMS technology without having to create bank accounts or having to physically carry cash. As a result, those who had been previously excluded from formal financial activities (i.e. saving money, sending money) can actively participate in financial industry.

M stands for mobile and PESA for a Swahili word for money. M-Pesa is sponsored by Vodafone.

Market Suggested Retail Price

$1.00

Target Users (Target Impact Group)

Household

Distributors / Implementing Organizations

M-Pesa is distributed by Vodafone for Safaricom.

Countries

Albania, Congo (Kinshasa), India, Kenya, Mozambique, Romania, Tanzania

Manufacturing/Building Method

N/A

Intellectural Property Type

Trademark

User Provision Model

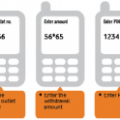

Registration for M-Pesa:

- Free.

- Step 1: Replace Your Old Safaricom SIM Card.

- Step 2: Register as New M-PESA Customer.

- Step 3: Activate Your M-PESA Account with the Start Key.

The channels to register for M-Pesa are:

- M-Pesa Mobile App

- www.mpesa.in

- USSD

- M-Pesa Call Centre

- M-Pesa Agent Outlet

Note: To register or transact at any M-PESA Agent outlet, you will be required to produce your original identification document, i.e., National ID, Passport, Military ID, Diplomatic ID or Alien ID/Foreigner Certificate.

M-Pesa Rates

- M-PESA charges will depend on the amount you are sending or withdrawing. Fees available online

- You can use your M-PESA menu to buy airtime for your phone, or for someone else. This service is free and you will only pay for the airtime purchased.

M-Pesa App available in India, on Itunes, Android and Microsoft store.

Distributions to Date Status

19.95 million subscribers as of 2014.

Design Specifications

Note:

- Maximum Account Balance is KSh 100,000

- Maximum Daily Transaction Value is KSh 140,000.Maximum per transaction is KSh 70,000

- You cannot withdraw less than KSh 50 at an M-PESA agent outlet

- To transact, your Safaricom line and M-PESA account must be active

- At an agent outlet, you cannot deposit money directly into another M-PESA customer's account

- You earn Bonga points when you transact on M-PESA.

Technical Support

Technical support provided by Vodafone, via email or call centers.

Replacement Components

N/A

Lifecycle

Versioning cycle unknown.

Manufacturer Specified Performance Parameters

None.

Vetted Performance Status

None.

Safety

N/A

Complementary Technical Systems

N/A

Academic Research and References

Nathan Eagle, txteagle: Mobile Crowdsourcing. MIT Media Laboratory.

Compliance with regulations

N/A

Evaluation methods

Customers’ reviews. Success stories available on the Facebook page.

M-Pesa App in India is rated 4.2/5 on Android as of July 2016; 3.3/5 on Microsoft store.

Other Information

Now is possible to send cash between M-Pesa customers in Kenya, Tanzania, DRC Congo and Mozambique, and MTN Mobile Money customers in Uganda, Rwanda and Zambia, since 2015.M-Pesa utilization tips.M-Pesa awards.

“Home.” n.d. Vodafone.Com. Accessed June 23, 2024. https://www.vodafone.com

User, Super. n.d. “Safaricom?: Premier Mobile, Data, & M-PESA Services.” Safaricom.Co.Ke. Accessed June 23, 2024. https://www.safaricom.co.ke/

Harrison, M. 2015. “Mpesa Rates: Safaricom Mpesa Withdrawal Charges & Tariffs.” MPESACHARGES: Spend Billionaires Money Games. July 21, 2015. https://www.mpesacharges.com/new-mpesa-rates-safaricom-mpesa-rates-withdrawal-transaction/

“BitPesa.” n.d. Bitpesa.Co. Accessed June 23, 2024. https://www.bitpesa.co/

“Bitcoin - Argent P2P Libre et Ouvert.” n.d. Bitcoin.Org. Accessed June 23, 2024. https://bitcoin.org/fr/

“CS181 Project.” n.d. Stanford.Edu. Accessed June 23, 2024. https://cs.stanford.edu/people/eroberts/courses/cs181/projects/2010-11/SmartPhones/pt4.html

“M-Pesa Users Get Access to Seven African Countries.” 2015. Business Daily. April 22, 2015. https://www.businessdailyafrica.com/bd/corporate/companies/m-pesa-users-get-access-to-seven-african-countries-2085472

M-Pesa Foundation. n.d. Accessed June 23, 2024. https://www.facebook.com/MPESAFoundation/?fref=nf

“Microsoft Apps.” n.d. Microsoft Apps. Accessed June 23, 2024. https://apps.microsoft.com/home?hl=en-in&gl=IN

Get more information about Solutions Library and its features.

Learn MoreHave thoughts on how we can improve?

Give Us Feedback