The term “Sustainability” is irrelevant in the 21st Century. Instead, we must think in terms of “Strong Transition.”

In recent years the terms “sustainable” and “sustainability” have become ubiquitous in development-speak. But these terms do not apply anywhere in the world today, and will not apply at all during the 21st century and beyond.

Consider the conditions of people throughout the developing world. Massive migrations are taking place as people seek refuge from conflict, water stress, ecosystem degradation, soil loss, political-economic distress, climate change, and sea-level rise.

Around the world, most people’s lives are characterized by uncertainty, change, disruption, and insecurity. In other words, conditions that far from resemble anything like stability or “sustainability.” Think of the migrants streaming out of the Middle East and northern Africa in effort to escape the violence in Syria, Iraq, Yemen, and Libya. Think of the millions of “climate refugees” on the move in sub-Saharan Africa, and ill-fated island nations and densely populated coastal zones in countries such as Bangladesh, India, and the Philippines.

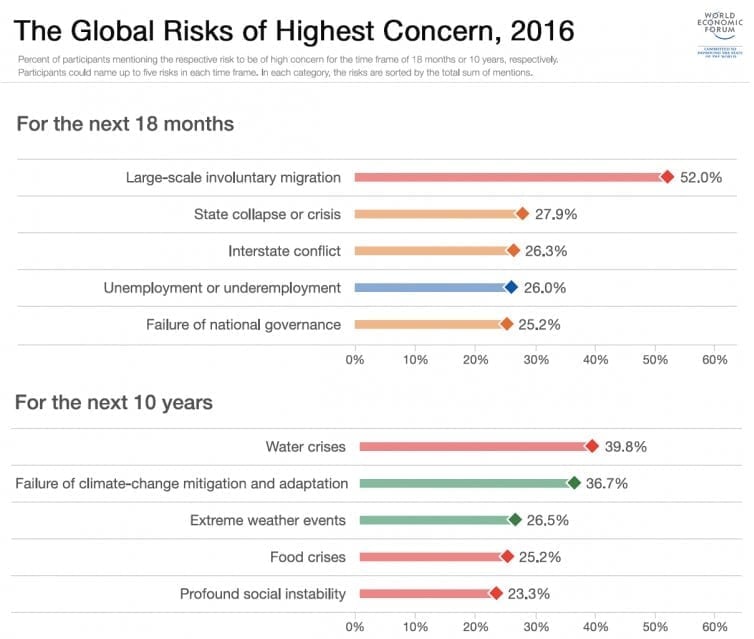

Instability, insecurity, conflict, and mass migration driven by ecological, political and economic calamities plague the future, according to the World Economic Forum. As Circle of Blue correspondent Brett Walton said, The World Economic Forum’s Global Risk Report is a “warning signal for turbulent times.” Nations are still saddled with debt and unemployment, The Middle East is a war zone, environmental damage, a warming planet and rising populations are causing conflict over land, food, and water. Ice sheets are melting, droughts intensifying and the sea is rising and flooding coastal cities more often. Ethiopia is at the brink of another famine and the Syrian civil war was caused in part by a drought, Walton says.

Clearly, people throughout the developing world are facing complex and mutually reinforcing circumstances characterized by profound environmental, political, economic, and social instability. Framing our responses as development professionals in terms of “sustainability” is therefore irrelevant and highly inappropriate. [Image source: World Economic Forum]

Since most people live in the so-called “developing world,” it can be accurately stated that “sustainability” does not apply to a large majority of the world’s inhabitants, and neither is it likely to apply to them anytime soon.

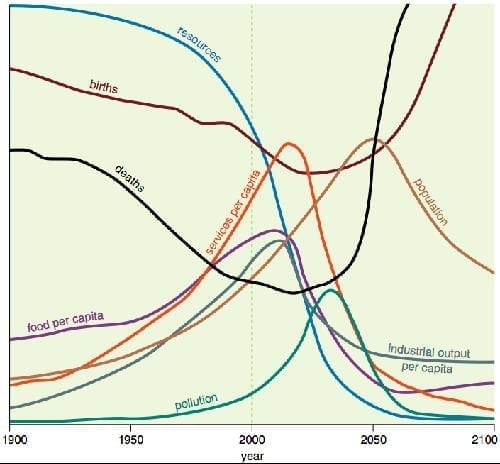

A bumpy road ahead for human civilization. Shown above is an exercise in scenario modeling from the much-maligned 1972 Limits to Growth study. Mainstream economists and technological cornucopians continue to claim that this study was debunked long ago. However, a recent study compared historical data with the original modeling projections and found that our actual trajectory has closely matched the most pessimistic scenario – one resulting in resource, economic, and population collapses in the first half of the current century.

What about the seemingly stable lives and lifestyles taken for granted among the global minority of professionals who live in affluent regions?

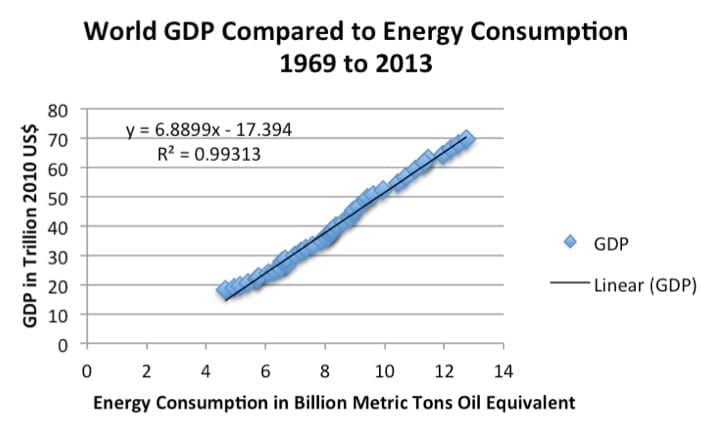

Little to nothing about our lives can be characterized as environmentally “sustainable.” Our current affluence derives from the past several decades’ of exponential economic growth – itself dependent upon a combination of constantly increasing extraction of fossil energy, and ballooning debt. There are bio-physical limits to our energy consumption and thus limits on economic growth and the extent to which we can inflate a decades-running debt bubble.

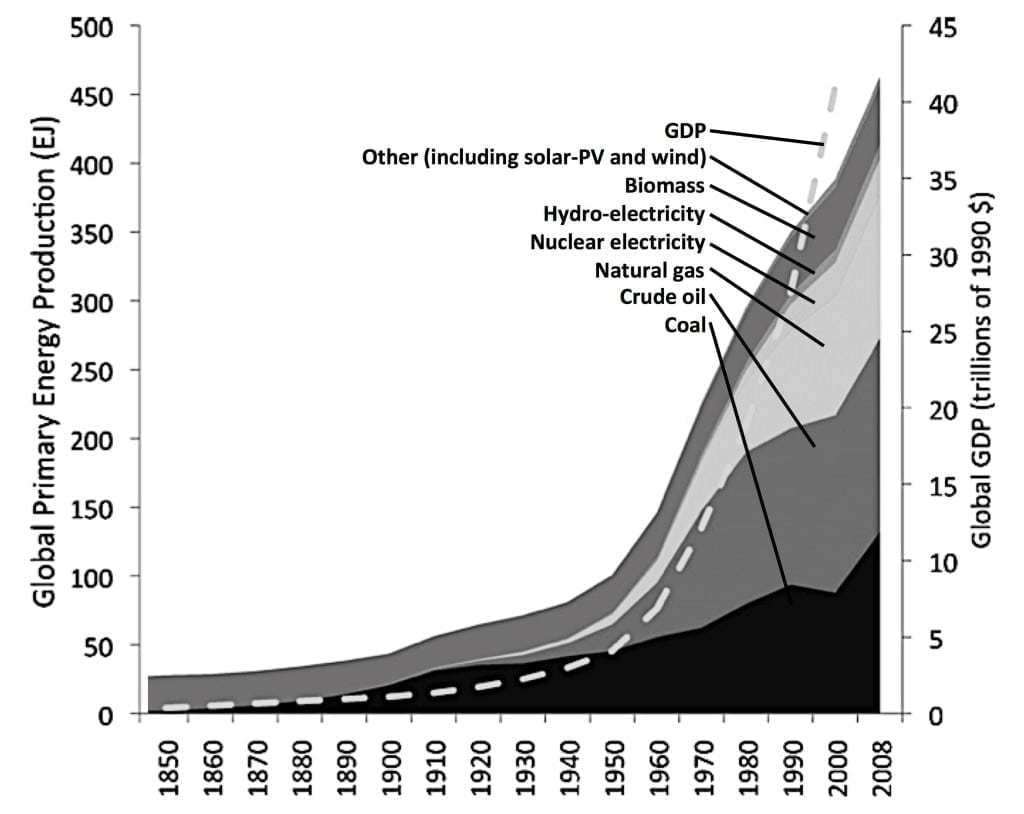

Energy gives rise to economic growth, not the other way around. The above plot from actuary and energy analyst Gail Tverberg shows a >99% correlation between energy use and economic growth as measured by GDP. Mainstream economists, who possess an “econo-centric” worldview and receive no training in the physical sciences, explain this correlation by suggesting that increasing monetary circulation in the economy conjures needed energy and resources. This is exactly backwards, as is obvious to any student of the natural sciences – access to energy as the “master resource” governs the expansion of a population’s activities. [Image source: ourfiniteworld.com]

Real economic growth derives from increasing exploitation of energy and resources; apparent economic growth can also be achieved, temporarily, by increasing debt. Taking the US as an example broadly representative of the global economy, this plot from energy and economic analyst Chris Martenson shows that US debt has been growing at more than twice the rate of GDP since the early 1970’s. Prior to 1970, oil prices hovered around $20 a barrel (in today’s money). Beginning with peak US oil production in 1970 and the oil shocks of that decade, energy costs began an inexorable rise in real terms.* To maintain economic growth despite increasing costs for obtaining our “master resource,” we turned to debt. Debt moves consumption from the future to the present, and makes us feel wealthier than we really are. Taking on debt isn’t inherently problematic – if future prosperity arrives supporting our ability to repay. But future prosperity will not manifest if the affordable energy and resources are not available to support continual economic growth. Then debts become un-repayable, and defaults are likely. Debt defaults can brutally punish economies and disrupt global trade.

*Hold on a minute! Expensive energy? Haven’t oil prices recently slid to below $30/barrel, a decadal low? The cheap (in price terms) oil we experience today is a product of (1) deflation and demand destruction by formerly high oil prices, and (2) the recent years’ flood of cheap debt into the energy sector which inflated the shale oil bubble through Ponzi financial schemes (similar to the housing bubble which almost destroyed the global economy in 2008, rescued only by trillions of taxpayer dollars given to bail out Wall Street). Today, we are in the troubling situation where both high oil prices and low oil prices are a problem. Producers – including those extracting high-cost oil such as shale drillers, tar sands refiners, and deepwater/arctic producers, as well as low-cost oil producers, such as Saudi Arabia, who nonetheless depend upon high resource taxes to support their government and economy – require high oil prices to support profitable production and debt service. However, high oil prices put the economy in a “choke-hold,” precipitating recession and reducing demand for energy products and services. High energy prices apply downward pressure on wages, induce layoffs and off-shoring of manufacturing, and kneecap efforts to transition to higher cost alternative and renewable energy forms. So – high energy prices crush society, and low energy prices crush producers. We are now in a dilemma where there is no “Goldilocks just-right” energy price that satisfies everyone in the economy. The current slide in oil prices is an ominous portent of deflation, not a herald of a new era of energy abundance. The cheap price belies the lack of affordability in a struggling economy where the wages of non-elite workers have stagnated or declined. [Source: peakprosperity.com]

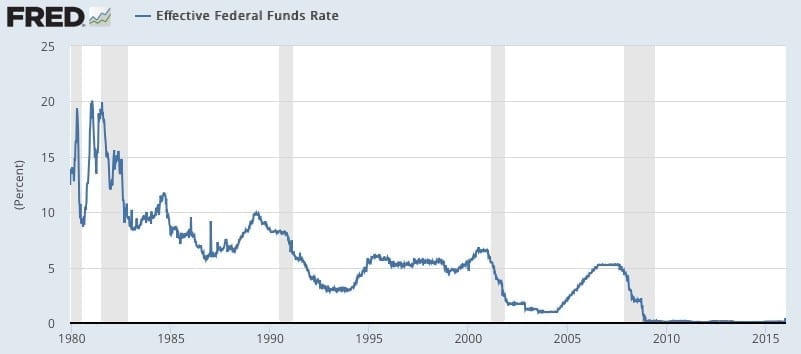

Reducing the cost of money only seems to make us richer. As energy – the lifeblood of our economy – became more expensive starting in the 1970s we increasingly turned to debt to support continued economic growth. To encourage more lending and debt-growth, interest rates (the cost of borrowing money) have trended downward since the early 1980s, as shown in the above plot from the St. Louis branch of the US Federal Reserve. Since the financial crisis of 2008, the Fed has held interest rates near zero in an effort to stimulate lending and a controlled rise in inflation, and kick the economy back into the steady few-percent rates of growth characteristic of the middle 20th Century. Lowering interest rates over recent decades has inflated bubbles in savings and loan, tech, housing, shale oil drilling, and assets on the stock market – but recovery in the rate of growth of the real economy (goods, services, employment) has failed to materialize because monetary policy cannot conjure cheap and abundant energy and resources ex nihilo (out of nothing). [Source: Federal Reserve Bank of St. Louis]

The 21st Century will thus see an end to the historically recent anomaly of exponential growth in the human economy driven by growth in our rate of energy and resource consumption. Since our society has come to depend upon increasing use of energy and resources, and our economy has been built to require growth to function properly, the 21st Century will therefore be a period of massive change, upheaval, insecurity, dislocation, and disruption in what have become our “normal” personal and professional lives. Again, descriptors such as “stability” and “sustainability” will not apply to our circumstances.

Therefore, in addition to failing to describe the present, near-term, and medium-term future circumstances of the majority of the planet’s human inhabitants, the personal and professional lives of the planet’s small minority of affluent denizens (including development professionals) are also very far from falling into the category of “sustainable.”

If the term “sustainability” is so inappropriate, why do we (affluent professionals concerned with development) keep using it?

The widespread (over-) use of the term “sustainability” reflects the subconscious desire of the affluent to maintain consumptive lifestyles and high socioeconomic status despite energy descent, ecological overshoot, financial breakdown, and economic contraction.

“Sustainability” is such a prized concept because it signifies the perpetuation of our primary societal narrative – that of continual technological progress and rising affluence.

The coming severe energy “diet.” The plot above, adapted from a paper by David Murphy and Charles Hall, shows world energy production and GDP from 1830-2000. The barely-visible area indicating “other” includes renewables such as wind and solar-PV. Due to their intermittency, lower net-energy (i.e., low energy return on energy invested, EROEI, compared to fossil fuels), and challenges for use in powering transportation systems, solar, wind and other renewable “green” forms of energy cannot stand in for natural gas, coal, and especially oil. Renewable energy platforms cannot be scaled up sufficiently, and rapidly enough, to replace our present levels of consumption of fossil fuels, let alone continue to grow our energy use in aggregate, as would be necessary for continual economic growth. The black, red, and yellow areas on the graph above thus give a sense of the severity of the unavoidable energy “diet” that we are embarking upon over the 21st Century.

“Sustainability” is a contemporary middle-class fad. Deep down we sense that our personal and professional lifestyles cannot be sustained – but change scares us and we are adverse to thoughts of giving up our status, privileges, comforts, and conveniences.

This helps to explain prevalent popular misconceptions regarding the potential of “green” techno-fixes such as electric cars, solar-PV and wind power systems, energy-from-waste schemes, economic “decoupling,” and so on, to facilitate our transition to sustainability.

In truth, these are examples of Weak Transition – the mindset that “Transition” means (simply) unplugging from dirty fossil energy sources and plugging into clean, green, progressive new technologies which will spur economic growth and sustain our desired rate of increase in material affluence. In other words, the belief that “green” technological innovation will permit familiar business-as-usual (B-A-U) and our preferred status quo to continue unabated.

This fantasy, however, will fail upon the rocks of environmental and economic realities.

For example, while solar-PV and wind power will play an increasingly important role in our energy future, they will not work as substitutes for fossil energy (especially liquid fuels needed for transportation), allowing our total energy use to continually increase year-upon-year as it did in the recent past.

What we face instead is a strict energy diet enforced by the laws of physics. In the future we will use far less energy than we do today. It is true that a much larger portion, on a percentage basis, of this energy will be met by sun and wind. Unfortunately, in their enthusiasm for Weak Transition to a “Green” B-A-U, renewable energy advocates and technological optimists often extoll the expanding market share of alternative energy platforms and transport technologies while ignoring the incipient precipitous decline in total energy availability implied by our impending energy diet.

This puts society at risk, since people who believe that a “green-tech revolution” will supplant dirty coal, natural gas, and oil with new “clean” energy and transport platforms are not motivated to contemplate the coming Big Changes in their lives and lifestyles, and to take appropriate preparatory action.

Our objectives as development professionals should not be to mount campaigns to sustain the unsustainable. Our objectives pertain to innovating and implementing adaptations and responses to dynamic circumstances characterized by energy and resource depletion, environmental disruption and ecological degradation, and economic contraction.

The popular prevalence of “Sustainability Thinking” is therefore highly problematic. It serves to lull us into complacency that, with sufficient innovation in the “green” sector, sustainability is right around the corner – implying only minimal disruption to our personal and professional lives and the comforts and privileges we enjoy.

As responsible Transition Scientists, Engineers, and Managers, however, we must resist communicating in “Sustainability” terminology as long as our actual circumstances continue to be defined by extreme Un-Sustainability.

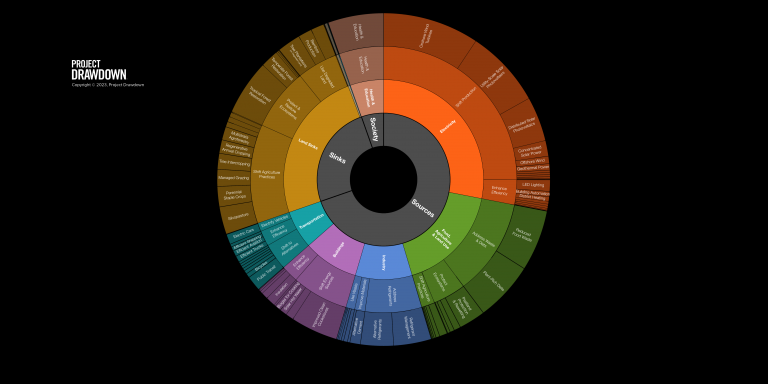

Our approach must be that of Strong (as opposed to Weak) Transition. Strong Transition involves the science of identifying risks associated with unsustainable resource use and environmental impacts, engaging adaptation and redesign of critical systems, and managing transformative change projects.

In the forthcoming series of posts we will investigate some Strong Transition initiatives as case studies. However, first we will have to tackle the cognitive bias endemic in our culture that promotes faith in techno-fixes and infinite progress and prevents clear-eyed reckoning with bio-physical limits to growth.

For more of Kearns’ views on the consequences of peak oil and Transition Engineering, please see:

The End of Global Development as We Know It.

Hi – great article. I COULDN’T agree more. SUSTAINABILITY is a very FRUSTRATION term and does a dis-service to the risks and OPPORTUNITIES that communities, businesses and governments around the world are facing. I’m particularly interested in the market/ business value that can be unlocked due to changing consumer expectations, resource constraints & extreme affordability. Its not on the periphery of future value it defines it!

Way to rip the bandaid off on that discussion. As a so-called “Sustainability Professional” I appreciate this accurate and sobering assessment of the world’s condition. In my darkest moments, it is that future that I fear, and I hold hope that we avert serious disaster – but these are all the views of a relatively affluent (rent is still a problem, but starvation is not) white, young professional, who is not faced with anything close to disaster quite yet.

Sustainability does need to be redefined. The goal does need to change. Our desired and realistic outcome has to be identified under a fluorescent light. It is very stimulating to think about the implications of this in a broader sense. On a personal level, this makes me want to buy land, learn how to grow my own food, obtain what materials I need and live off the land as best as I can.