Suggested Articles

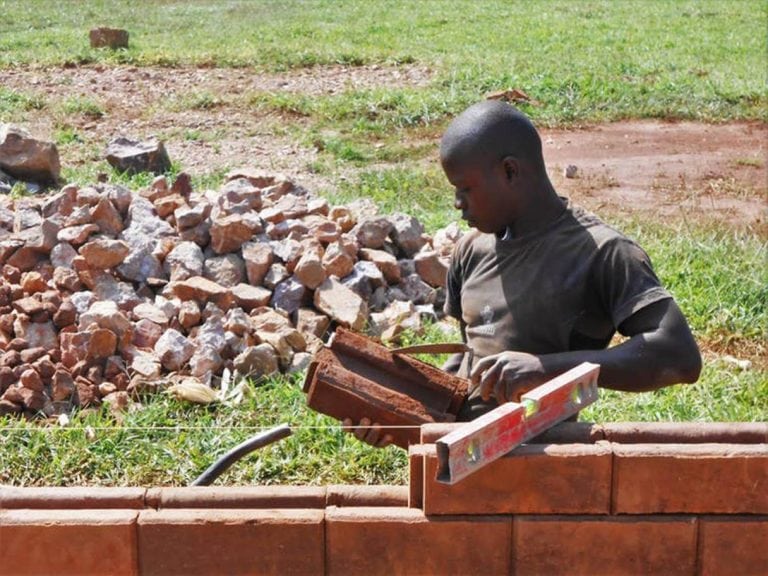

‘Supermud’ bricks could help tackle the world’s housing crisis and...

Featured

The world is about to experience one of the biggest housing booms in history over the coming decades. In the UK, the housing crisis is a recurring news...