Editor’s note: Demand: ASME Global Development Review is shuttering after six years of publishing research, in-depth coverage of the most interesting manifestations of design, engineering and social ventures in global development. The biannual magazine was a premier source of global development writing and a sister publication to Engineering for Change. As an homage to Demand and the work of the experts whose voices it disseminated, we are reprinting Demand’s articles on this site.

This month we offer a case study on the Nigerian Wi-Fi startup Tizeti. The company’s founder Kendall Ananyi provides four updates since first publication in 2018.

- More than 500,000 devices have accessed the network

- Tizeti is in the midst of an expansion outside of Lagos to operate in Ogun and Rivers State (Nigeria)

- The company is preparing to expand into other African countries, begining with Accra, Ghana, next month

- Tizeti recently aunched wificall.ng, a voice service that runs over WiFi

Wi-Fi? Why Not.

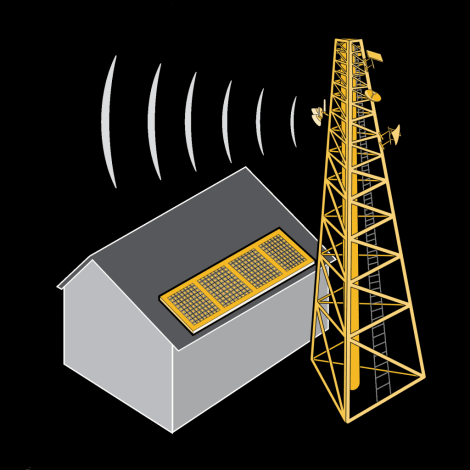

Internet usage in Africa still lags woefully behind most of the world. Nigerian startup Tizeti is introducing a new concept to its home city of Lagos: unlimited internet. And it is doing this by building one solar-powered communications tower at a time.

Michael Seibel first took note of the Nigerian startup Tizeti at a conference he attended in Lagos in September, 2016. Seibel is CEO of YC, Y Combinator’s startup accelerator program. YC, headquartered in Silicon Valley, had invested in Nigerian companies before, and Seibel had traveled to Lagos at the behest of several of those startups, encouraged to seek other new companies to enroll in the accelerator.

Upon arrival, Seibel had two impressions. One was the proliferation of mobile technology.

“Tons of smart phones,” he says.

The other was the state of the city’s infrastructure, which was either not built, or not in good repair.

“The big takeaway I had was that there’s a lot of infrastructure work that startups could do,” Seibel says. One exception was his Wi-Fi connection at an event he attended.

“We were at an event powered by wifi.com [wifi.com.ng], and the internet was good. The Wi-Fi was good,” Seibel says, laughing. “I met the founders and heard their story. I learned how much infrastructure they put in the ground with how little funding, and how they were getting people to pay for their service. They were offering high-speed internet, something I take for granted in the U.S.,” he says. “They were effectively a first mover. I said to myself that this is perfect.”

“I can’t predict the next Snapchat or Instagram of Nigeria. But I sure as hell can predict that people want high-speed, unlimited Internet, so if there’s a startup out there getting it done, I want to help them.”

The Wi-Fi was supplied by Tizeti Network Limited, which provides its service through wifi.com.ng. Since 2012, Tizeti’s founder Kendall Ananyi and his colleagues have been building solar-powered Wi-Fi base stations in Lagos. They were, and still are, creating a product that has not been seen or is rarely seen in the city: unlimited internet over Wi-Fi. Tizeti is a startup at the crest of a wave of technological infrastructure construction and product innovation in Nigeria and across Africa. That momentum supports the company’s expansion; at the same time it pits the company against resistance to an unfamiliar product. The company is capitalizing on better and cheaper solar technology and Wi-Fi, as well as the recent arrival of new undersea fiber optic cables, which are delivering the global internet to Nigeria and other parts of the African continent. But even with support from new infrastructure, Tizeti may be in for technological headaches in the future. Its customers are likely to demand greater capacity from Wi-Fi towers that have an upper limit. The company will either have to accept the substantial costs of licensing spectrum—the electromagnetic radio frequencies used to transmit mobile phone calls, television broadcasts, and internet data wirelessly— from the Nigerian government, or they will have to compete among other internet service providers (ISPs) on crowded frequencies, which will likely mean interference and poor service for Tizeti’s customers. For now, however, the startup is using a recently secured $2.1 million investment to license spectrum and build base stations more quickly than at any time in its five-year history.

At the time that Seibel decided to approach Tizeti, he equated the company to a young AT&T, when the U.S. telecom giant was a small startup scrambling to build telephone infrastructure—“when AT&T was a hot tech company,” Seibel says. “I told myself I shouldn’t be sitting here thinking that startups just have to work on the top-most user layer of technology. At some point, a startup did every step.”

The comparison led him to consider forgoing the risky game of guessing which phone application or software company will be the next to take off in Nigeria. Instead, he placed his bet on the hardware that can support those applications.

“I can’t predict what high-level consumer products will be the Snapchat or Instagram of Nigeria, or whether Snapchat and Instagram will just be the primary products there, too,” Seibel says. “But I sure as hell can predict that people want high-speed, unlimited internet, so if there’s a startup out there getting it done, I want to help them.”

Connecting the Unconnected

The explosive growth of mobile phones is one of the best-known success stories of technology adoption in Africa, but internet connectivity has not caught on as quickly. Mobile phone ownership rates among adults in Nigeria, Ghana, and other African countries are nearing 90 percent, and just about match ownership rates in Europe and North America. Subscriber growth rates are slowing as they approach the global average, but 168 million more Africans are expected to connect to mobile services by 2020. Nigeria is one of eight markets expected to lead the growth. Meanwhile, the number Africans getting online only recently hit 20 percent. That is because most of Africa’s mobile phones are not smartphones. Nigeria’s smartphone ownership rate is among the highest on the continent at 27 percent—nearly double the region’s median rate of only 15 percent, but still far below the worldwide average of nearly 50 percent and the European average of 76 percent, according to the Internet Society’s 2016 Global Internet Report and the International Telecommunication Union. By 2020, as many as 60 percent of Africans may still not have internet access. That speedbump in growth implies that the work to connect the unconnected “will take significant and concerted efforts,” the ITU says.

Steve Song is an advocate for cheaper, wider access to communication infrastructure in Africa. He is the founder of Village Telco, a social enterprise that builds low-cost Wi-Fi mesh voice-over-internet protocol (VoIP) technologies to deliver affordable internet and voice service in under-serviced areas. “I think it is a more optimistic time for ISPs in Africa than it ever has been,” Song notes.

Song researches wireless spectrum at Network Startup Resource Center in Eugene, Ore., in addition to his work at Village Telco.

“Wi-Fi networks, whether deployed by startups, municipalities, or [telecoms] incumbents, are exploding across the continent. I have been tracking the growth of Wi-Fi in Africa for some years, and this year and last represent a huge uptick in deployments, of which Tizeti is just one,” he says. Song attributes the trend to the expansion of fiber optic infrastructure across the continent. “The arrival of serious undersea fiber optic capacity in 2009 has sparked a huge change,” he explains.

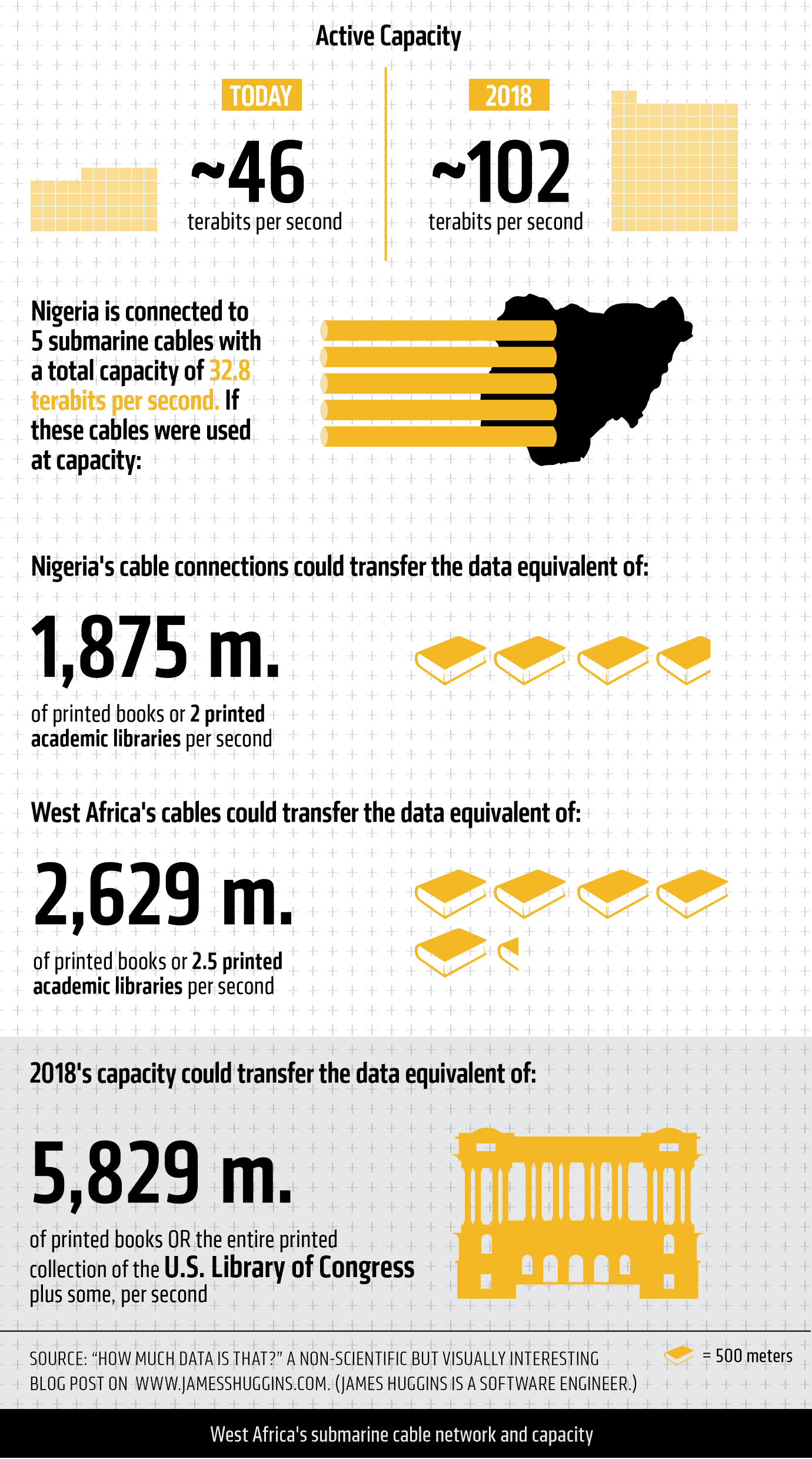

From the year 2000 to 2009, five undersea cables were laid to serve all of Africa. Then in 2009, two cables, SEACOM and TEAMS, arrived to connect the Middle East to ports along Africa’s eastern coast. These cables are still operational and have the capacity to transfer 1,280 gigabits-per-second of data. That is equivalent to transferring the same amount of information found in 1,450 meters of stacked books—per second. The SEACOM and TEAMS cables are small compared to what has since come online. Nigeria itself is now served by five undersea cables with the capacity to deliver 32.8 terabits-per-second of data. That is whole libraries worth of information per second, rather than shelves of books. Four new cables are slated for completion between this year and next, each with capacities of 30 to 60 terabits-per-second. Nigeria and the rest of Africa’s western coast will be served by cables with a combined data transfer capacity of 102 terabits-per-second by 2018.

“The undersea capacity has sparked a wave of investment in terrestrial capacity as well,” Song explains. “Virtually all of the existing terrestrial fiber was built in the last eight to 10 years. This means that real broadband has come to Africa. And Wi-Fi, because it is so cheap and is built into all smartphones, is a natural way to exploit that capacity.”

The arrival of undersea fiber to Africa has yielded a new communications access problem, Tizeti’s founder Ananyi says. “The problem used to be that there are no submarine cables. Now there is a ton of capacity in submarine cables but not enough ISPs.”

Deep Pockets

Ananyi left his home in Lagos to study electronics and electrical engineering at the University of Victoria in British Columbia, Canada. He worked with Microsoft, Exxon, and PwC. Then he moved back to Nigeria with ideas for a video on demand service, but he found that internet connections in the city were slow.

“We decided to solve the internet problem,” Ananyi says, referring to himself and his business partner. “We had this idea of unlimited internet [at a] cheaper [rate] than telcos could offer. We first started providing service to buildings, then formalized it as wifi.com.ng.”

Since its launch in 2012, Tizeti has scrambled to build Wi-Fi base stations using its earnings along the way. The company would build one station, then collect revenues from its services to finance the next tower—an approach that created financial strain for the young business.

“We struggled with getting financing at the right terms; the inbound investment offers we got would have required us to alter our model,” Ananyi recalls. The early investors they spoke with wanted them to switch from an unlimited internet service offering to a capped-data service.

“We politely rejected the offers and continued to bootstrap the business from revenue from the customers,” he adds.

Enabling online payments and recurring billing made this easier for Tizeti because it could collect customer payments ahead of time.

Meeting Seibel changed the equation. Participating in YC presented an opportunity for Tizeti to meet the kinds of investors that Ananyi wanted. In January 2017, he started YC’s three-month accelerator program, becoming part of an alumni network that includes the founders of Reddit, Airbnb and Hipmonk, as well as lesser known social startups like medical treatment crowdfunder Watsi and person-to-person lending platform Zidisha, both of which operate in emerging markets. Per YC’s standard terms, the accelerator

invested $120,000 into Tizeti as seed capital in exchange for a seven percent share of the company. It also connected Ananyi to a group of investors who subsequently committed more than $2 million. Seibel himself invested an undisclosed amount.

At the time of writing, Tizeti has erected 46 solar-powered base stations around Lagos and plans to add 54 more in the next 12 months. Ananyi declined to discuss many of the towers’ specifications to avoid compromising proprietary secrets, but he did reveal that the small, 30-meter towers transmit Wi-Fi on a 5-gigahertz band across a radius of about 1.5 kilometers. Tizeti builds the towers with a greater-than-usual density to provide more capacity to the customers.

“We are on track to have more towers than a typical telco per square kilometer once we complete building our network in Lagos,” Ananyi says.

We had this idea of offering unlimited internet at a cheaper rate than other telecom companies. But investors wanted us to switch to a capped-service.

By comparison, the established telecom companies, or “telcos” in industry-speak, are “quite limited,” Ananyi says. “The average speed in Nigeria is 5-megabytes (MB) to 10MB per second. Our equipment can deliver up to 100MB to each customer.”

While the incumbent telecoms have greater coverage, Tizeti’s pitch is that it can provide more data at faster speeds. It currently offers home internet service, but it is also planning to launch 3,000 public Wi-Fi hotspots throughout Lagos, Ananyi says. Tizeti is aided by dramatic improvements in technology. For instance, the cost of installing solar panels has declined by 60 percent over the last decade, owing to improving efficiency and falling prices of photovoltaic solar technology. Wi-Fi technology has benefited from similar trends.

“Wi-Fi has gotten cheaper and cheaper while getting faster and better,” Song says.

Solar Base Stations: Genius or a No-Brainer?

Diesel is king in Lagos, as in many emerging markets. Power supplies are spotty and blackouts and brownouts are common. To ensure that mobile phone reception remains intact when the power cuts out, telecom companies employ diesel generators as back-up power for their base stations. That service has costs, however, both environmental and financial. Environmentally, diesel generators used by households and businesses alike contribute to air pollution, which often tips into unsafe levels in large urban centers like Lagos. A 2014 study published in the Research Journal of Agriculture and Environmental Management assessed diesel generator fumes in and around Lagos and found that concentrations of pollutants far exceeded the Nigerian Federal Environmental Protection Agency’s standards: carbon monoxide was two to five times higher than the one part-per-million standard; sulfur dioxide was as much as 35 times higher than the 0.1 part-per-million standard; and nitrogen dioxide was more than 25 times higher than the 0.06 parts-per-million standard, the study found.

Then there is the monetary cost of using diesel. Not just the price of the fuel, but the expense of delivering it.

“The issue is that every day you have to go out and refuel the generators,” Siebel says.

The costs can impose a significant operational and financial burden to businesses. Tizeti avoids both problems by using solar panels.

“Power is a big deal in Africa. Expenditure is high on diesel,” Ananyi says. “Using solar power, I’m able to transfer the running costs of diesel. We can use the savings to pass more data to the customers and offer an unlimited, uncapped service.”

Ananyi’s solar-powered sidestep of the diesel problem impressed Seibel, who views it as an example of the nimble decision making that defines startup culture.

“They rigged up this system, and it started working, and suddenly everyone else’s towers had to deal with this problem that they didn’t,” he says.

To Steve Song, the decision for solar does not seem so much a display of startup ingenuity as simple logic.

“Yes, solar is much cheaper than diesel, but powering Wi-Fi via solar is a bit of a no-brainer because Wi-Fi draws so much less power than GSM, 3G, and LTE towers,” Song says. While Tizeti may be saving money with solar-powered base stations, Song predicts that the company’s deeper, recurring expense will be internet backhaul.

Expensive Backhaul

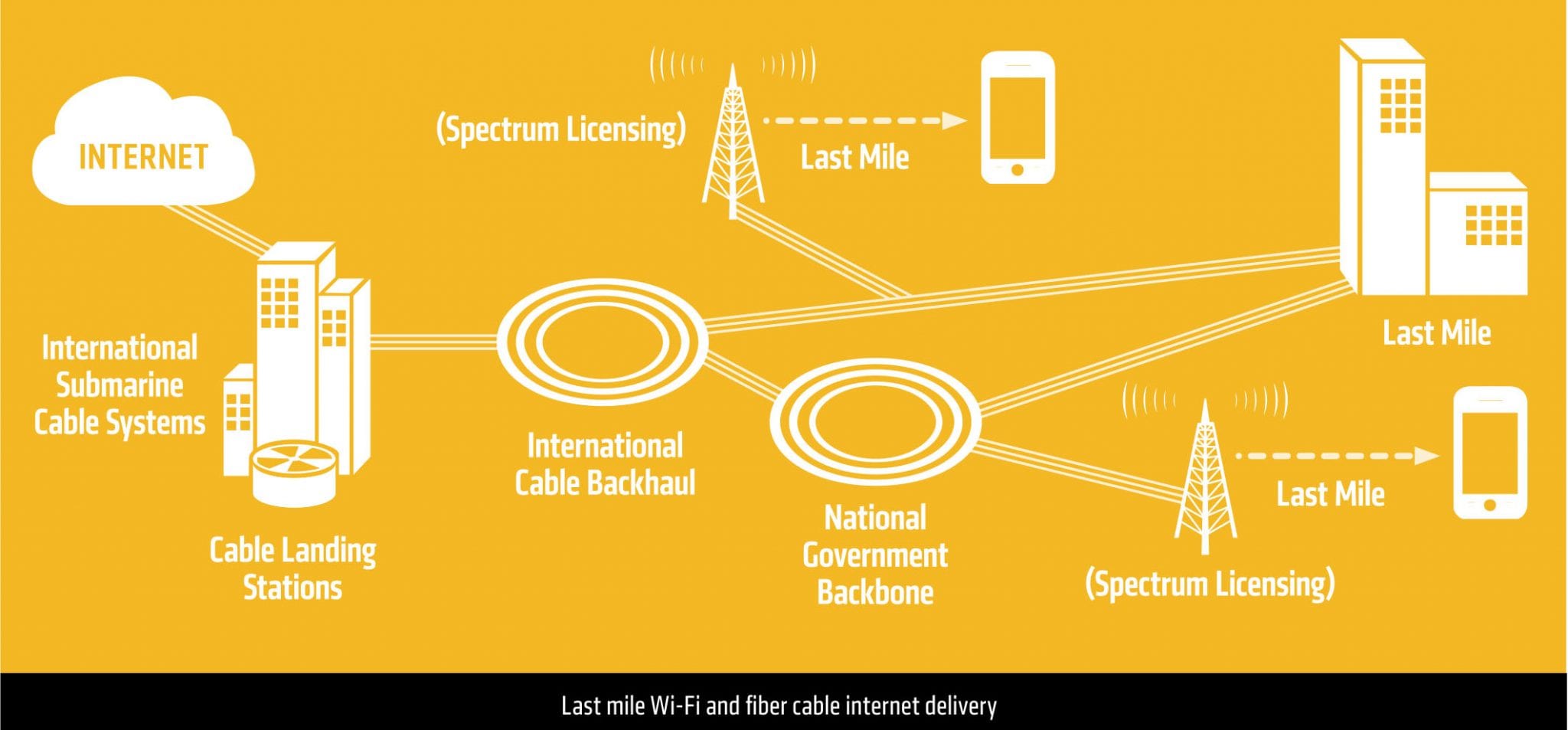

Backhaul refers to the infrastructure and bandwidth purchase agreements that allow internet service providers like Tizeti to connect customers to the internet. Accessing backhaul is expensive because it typically requires laying terrestrial fiber and purchasing wholesale bandwidth from an international undersea cable landing station.

Tizeti may be able to put off the expense of laying fiber for now by relying on its Wi-Fi towers. Its 5.8-gigahertz microwave broadband antennae can beam a signal to any point in direct line of sight. This setup can transmit over tens of kilometers where the line of site is uninterrupted; when it is interrupted, multiple towers can link around obstacles blocking the signal. Aravind Eye Hospital in Tamil Nadu, India, for example, relies on a long-distance Wi-Fi network to deliver medical services to underserved communities. Using Wi-Fi base stations that are spaced five to 15 kilometers apart, the Technology and Infrastructure for Emerging Regions group at the University of California, Berkeley helped the hospital network establish video links between its hub and rural satellite clinics.

Wi-Fi transmission technology has limitations, however. The cost of building towers high enough to achieve long-distance lines of sight can be high, both up front and for ongoing maintenance. So-called “daisy-chained” towers also introduce potential points of failure in the network. And finally, what may be the most important caveat, Wi-Fi network capacity may be high for now, but that may not be future-proof.

“Capacity is limited on 5-gigahertz [bands] to a few hundred megabits per second, which is a great start, but demand for data is ballooning and that is not likely to serve for long,” Song says.

The 5-gigahertz frequency can get crowded in cities, leading to interference in the signal. Interference was a problem with Tizeti, Ananyi says, before the company started licensing spectrum in other frequencies from the Nigerian government. The tactic has been “very expensive, but the quality of service improved,” he adds. Tizeti has reserved spectrum access in Lagos and outlying regions to the south and southwest of the city. Gaining access to more will be increasingly important for an internet service provider that needs room to grow.

“Wi-Fi is awesome, but if these startups do well, they should be allowed access to more spectrum,” Song says, adding that this remains a challenge for new providers because regulators are not quick to release new spectrum, and they often prioritize telecommunications incumbents when they do.

“The best solution in my opinion is a combination of fiber, where fiber is available, and then extending access 10 to 30 kilometers off that fiber with one-hop Wi-Fi links,” explains Song. Fiber can support long-distance Wi-Fi where radio links are limited, but, he adds, “that brings us back to the cost of fiber backhaul.”

Regardless of the strategy, Tizeti’s business model depends on spending money.

“They have real costs. Any time you put infrastructure in the ground, you have to put money up front and hope to get paid back,” Seibel says. “At the end of the day it represents a risk.”

Making a new pitch

Hardware forms the backbone of Tizeti, but it is still only part of the business. Tizeti is operating against a network of established telecom providers that have fostered an entrenched set of expectations among Nigerian internet users. One is that data is capped and priced by the megabyte, rather than unlimited. Another is that the internet service is tied to the phone service.

“You have to make this pitch to customers when everyone in the market is making the opposite pitch,” Seibel says of Tizeti. “Everyone in the market is saying get your internet from a telco. Your internet and your phone bill are the same thing. Tizeti has to say no, wait, you want unlimited internet in your home. That’s a cultural change.”

Africa has proven adaptable to changes in billing and payment methods, however. One of the continent’s technological success stories is the increasing ubiquity and sophistication of mobile money services. In Nigeria, the mobile money market is not as mature as some of its African peers, like Kenya. Kenya is the birthplace of M-Pesa—considered the “gold standard” for mobile money. Nevertheless, mobile payment options are improving in Nigeria, and this opens the door for companies like Tizeti that are rewriting traditional service models. Tizeti is certainly operating in rocky soil, Seibel says, but Lagos contains soil for a startup.

“[Lagos] feels like the heartbeat, not only of the country, but of the region,” he says. But the power goes out, and transportation can be slow—building a business there takes grit. Seibel seems to think that Tizeti’s leadership has it. “One thing I always look for in founders is whether they are solving their own problems,” he says.

As Tizeti winds down its fifth year, Ananyi has set sights on other markets— West Africa’s English-speaking countries most immediately. His goal is not expansion for its own sake, but to solve an important problem on the continent.

“Internet is huge in Africa, but it’s still a big problem to have access,” Ananyi says. “We’re trying to solve it for as many people as possible and go everywhere.”

Hi, This is a very nice article and gives a lot of insight. I am however concerned about the sustainability of the connectivity. Has there been work around it? The other thing that I would like to say is about community involvement and community benefit that comes about from this connectivity. I have been working in this domain since the past years and have faced various challenges in making connectivity a sustainable and meaningful proposition in connecting the unconnected. Good work. Regards, Sarbani